Contents:

They spend a lot on video games but are smart about shopping for them. If you’re interested in selling video games, be smart with the niche you want to enter because although video games offer huge profit margins, there’s plenty of competition in this field. In today’s article, you’re going to learn about how to get started with retail arbitrage, the best stores to buy your products, and the best products to buy cheap and sell high. There are pros and cons to each order type and these are only learned through practice. Knowing the order type is only the how, it does not help with the where and when – which would be up to a trader’s analysis or strategy to determine. If in the next session the opening price surpasses the predefined entry level , the sell limit order becomes a sell market order.

FX Profitude Trading System Reviews: Russ Horn Rapid Results … – Tacoma Daily News

FX Profitude Trading System Reviews: Russ Horn Rapid Results ….

Posted: Fri, 20 Jan 2023 08:00:00 GMT [source]

To make a profit from retail arbitrage, you need to be able to find great deals on products so you can sell at a higher price point while still being able to compete with other stores. Closing a position by market is the fastest way of exiting a trade without any delay. To do so, traders using the MT4 trading terminal, need to double click on any open order, right under any of the “Price” tabs. It saves traders the trouble of adding them in later, or forgetting and leaving a position open without the safety and the gains levels input.

Investing For Beginners: The 6 Best Investments To Get Started

Part of trading is being able to maximise your profits, so this means knowing when to get out too. This is exactly how the world works now, buying something for a certain price and then trying to sell it for a higher value. Only the most seasoned investors can ignore public sentiment and buy when stock prices are plummeting and sell when they are soaring. You need to understand why a company’s stock is going up or down to determine if it’s time to buy or sell, and that kind of comprehension is difficult even for professional investors. On the other hand, when market prices are soaring, many traders want a piece of the pie and end up overpaying for stocks.

What is scalping? A beginners’ guide to scalping trading strategies – FOREX.com

What is scalping? A beginners’ guide to scalping trading strategies.

Posted: Wed, 05 Oct 2022 07:00:00 GMT [source]

We will be illustrating when to use them and the reasons for applying each type, along with their advantages and disadvantages. When the https://forexanalytics.info/ candle of the previous day closes, place a buy stop above the daily high, and a sell stop below the daily low to catch the breakout. Now look at the image below and see how the price violates the daily breakout to the upside once it reached above 50% of the possible trend. Unfortunately, it’s easy to determine after the fact whether a price was too low or too high and even why.

and never miss a signal again!

When any trend finishes, we will enter the market to catch the next move from the very beginning. The daily high low based forex trading strategy is a breakout trading strategy from the high and low prices in the daily timeframe. In forex trading, the daily timeframe is crucial as most of the significant market players use this time table in their trading. As a result, any trading strategy in the daily time frame provides better trading results compared to the lower time frame.

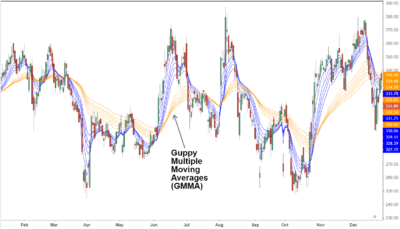

For swing trading using pin bar you need to use higher time frames like 4 hour or daily or weekly charts. Since market prices are affected by how people feel and think, it can be hard to use this technique. Consequently, traders rely on a wide variety of other indicators, such as moving averages, the economic cycle, and consumer mood, when making their buy and sell decisions. In the next paragraphs, you will learn how to implement this strategy.

The movement of the 50-day MA above the 200-day MA shows that the price is gaining upward momentum, which could lead to a price increase. There is no foolproof technique to predict the market or the direction that stock prices will go at any particular time. Therefore, if stocks haven’t hit their lowest or maximum values, investors who act prematurely while buying or selling stocks run the risk of losing money. The dynamics of stock market cycles are the foundation of the buy low, sell high trading strategy, meaning it’s designed to enable you to profit from the stock market prices’ volatility. Now that you understand the basics of forex trading, let’s talk about the secrets of how to buy low and sell high – consistently and profitably. The key to successful forex trading is to buy low and sell high.

Tip 2: Use Fibonacci Tools to Time Your Entry

Once traders know the different types of orders , and become comfortable using them, they can apply them to better fulfil a trader’s intentions of how to best enter and exit the trade. On a profitable long position, the stop loss order can be set to the breakeven level, or profit zone, to safeguard it against the chance of a market reversal against the currently profitable position. If the trade becomes profitable by a certain number of pips, it is generally a good idea to move the stop loss in the profitable direction to protect some of the profit. One of the most effective ways of limiting losses is through a pre-determined stop order, called a stop loss.

- This information is for educational purposes only is not meant to be a solicitation or recommendation to buy, sell, or hold any securities mentioned.

- In short, Pivot Lines are a famous indicator to help you forecast likely future points of resistance and support to limit risk and find profit targets.

- If the price breaks above the high of yesterday’s candle, it may move further high.

- Traders should set the stop loss to also allow for the trade to have room to breathe, to be free to develop, instead of setting a tight level and exiting the trade on an insignificant correction.

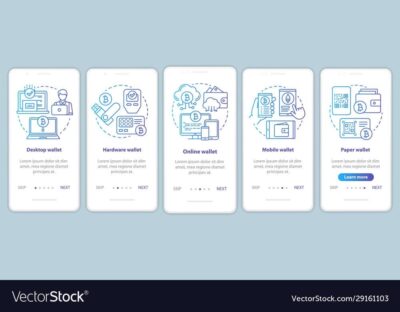

Stay on top of upcoming market-moving events with our customisable economic calendar. Market trading with Fundamental and Technical Analysis to provide you guaranteed win-win situations while trading. We offer you how to learn Technical Analysis in simple way by using world famous Automatic Buy Sell Trading Software and provide some Unique Techniques and Methods to guess where markets derive to…. Once you understand the basics of Forex trading, you will need to choose a broker.

Over the long term, the drivers of the market as a whole follow a consistent pattern, moving from fear to greed and back to fear. Times of maximum fear is the best time to buy stocks, while times of maximum greed are the best time to sell. New forex traders should first attempt to make profits and only use leverage after learning how to profit consistently. It is always possible to take either side of a trade in the forex market.

Moving averages are used by investors to determine whether a stock price is high or low. The best way to learn Forex trading is to start with a demo account and practice trading with virtual money. It is also important to read books and articles about Forex trading, and to attend seminars and webinars to gain knowledge and experience.

“Buy Low, Sell High” is preached about so often by investors that it’s almost become a cliche. The mantra may sound a little too simple and obvious, and, sure enough, this investment strategy requires more strategizing than you’d expect. This investor’s guide will teach you the simplicities and intricacies of “buy low, sell high” investing. While the common investment advice to buy low and sell high may seem like a simple idea, it’s not a good option for the average investor.

Because we recommend you locate the https://day-trading.info/ of the trend and find a good entry, DailyFX has a new concept for you to consider. This article will provide you with methods to do just that to prevent you from catching a falling knife. I founded this site back in 2007 after losing $50 to a data entry scam. I wanted to make sure no one went through that same experience. My goal has always been to help regular people learn the true, legitimate ways of making money online. Apply this strategy to every occasion or season people spend money, so you’ll be buying and selling items throughout the year.

Here, we’ll explain what “buy low, sell high” is really about and give you some quick tips and tricks on how to do it. An indication that the stock price is sharply growing is when the 50-day average exceeds the 200-day average. Stocks you buy right now are likely going to increase in value. A buy-and-hold investor, meanwhile, might buy stocks and hold them for many years or even decades.

What are Market Orders?

You recognize that the company will probably be fine, and you jump on the opportunity to buy shares at a low price. Next year, when the company generates record sales, the stock price rebounds, and you’re able to sell your shares for far more than what you bought them for. While those are clear when looking back, this is not an easy metric to pinpoint. The price of a stock at any given time is based on the supply and demand at that moment in the market.

However, there is some https://forexhistory.info/ condition where price moves to a range and violates the movement above or below the candle high. If the price breaks above the high of yesterday’s candle, it may move further high. If the price breaks below the low of yesterday’s candle, it may move further low. Market cycles include four phases of market growth and decline, which is driven by business and economic conditions. “Animal spirits” is a term used by economist John Maynard Keynes to explain how human emotions can drive financial decision-making in volatile times. Traders profit by betting that a currency’s value will appreciate or depreciate against another currency.